Gioielleria vera da 40 anni

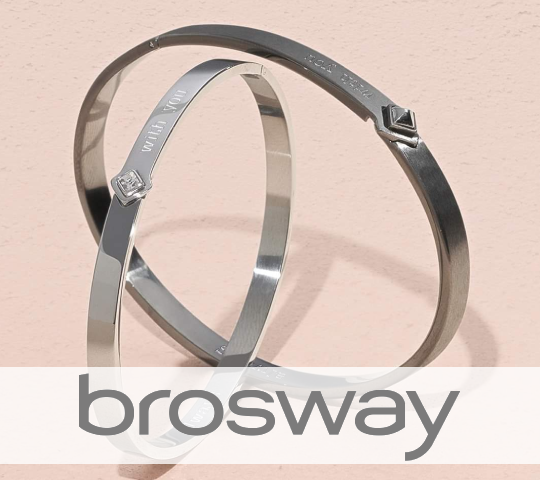

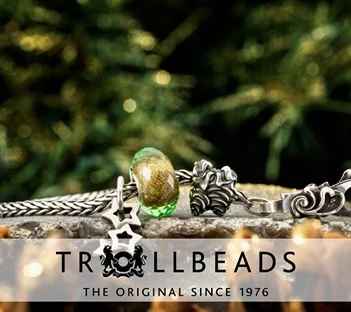

La nostra Gioielleria online è proprio come il nostro negozio. Qui trovi tutto quello che c'è in store e lo puoi ordinare direttamente online e vedertelo consegnare in pochissimo tempo con il nostro corriere espresso. Puoi trovare con semplicità tutto ciò di cui hai bisogno grazie al nostro catalogo online con sezioni specializzate nelle principali occasioni con soluzioni adatte a qualsiasi esigenza, che si tratti di un regalo speciale o di un accessorio per completare il look di tutti i giorni.

Abbiamo pensato a tutto per rendere l'esperienza di acquisto facile, piacevole e veloce. Puoi usare il nostro menu diviso in sezioni per cercare l'orologio da uomo solo tempo che cercavi o il gioiello con simbolo della pace che significa tanto per te ed usare i filtri per scegliere tra gli oltre 3000 articoli disponibili.

Una volta scelto potrai procedere all'acquisto e scegliere se ricevere a casa in pochissimo tempo il tuo acquisto oppure passare a ritirarlo in negozio appena sarà preparato. In ogni caso avrai sempre confezione ed astuccio a corredo, perfetto per fare un regalo! Tutti i prodotti sono accompagnati da un certificato di garanzia.

Con una vetrina on line da oltre 10 anni spediamo in tutta Italia e all'estero a prezzi competitivi, con reso facile e con la massima assistenza pre e post vendita. Registrati alla nostra newsletter se vuoi rimanere aggiornato sulle nostre novità e le promo con i nostri codici sconto.

.jpg)